What a Trial Balance Does

A Trial Balance lists the closing balances of all accounts in the general ledger. You place each balance in either the debit or credit column. After you add the columns, the totals should match.

When these totals match, the ledger entries are arithmetically correct.

After you finish the Trial Balance, you use its balances to prepare two main financial statements. These statements help you understand how well the business is doing.

1. Statement of Profit or Loss

The Statement of Profit or Loss shows the business’s income and expenses for a period. As a result, it clearly tells you whether the business made a profit or a loss.

This statement helps you see the company’s performance over time.

2. Statement of Financial Position

The Statement of Financial Position shows the company’s assets, liabilities, and equity on a specific date. Because of this, it gives you a clear snapshot of the business’s financial health.

You can easily see what the business owns and what it owes.

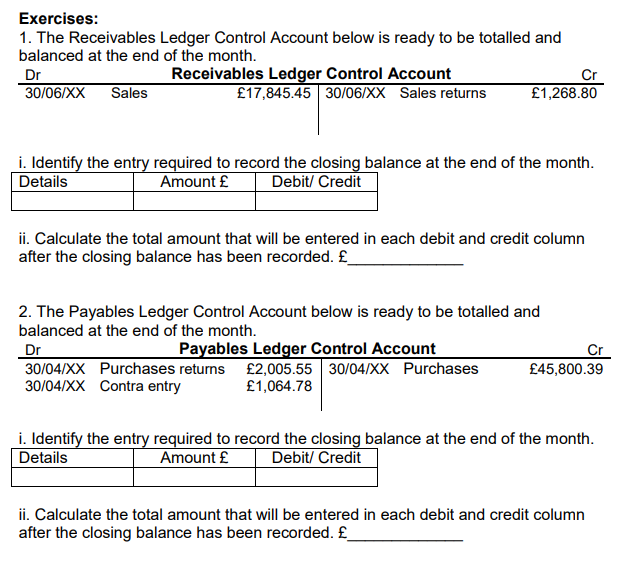

How to Balance a Ledger Account

Balancing a ledger account is simple when you follow these steps:

- Add the debit side and the credit side.

- Find the higher total, and write it on both sides.

- Calculate the difference, and write it on the side with the smaller amount. This amount is the Balance carried down (Bal c/d).

- Bring the balance forward by writing the same figure on the opposite side below the totals. This becomes the Balance brought down (Bal b/d) for the next period.

Because these balances carry forward, they become the opening balances in the next accounting period. You then place all Bal b/d figures in the Trial Balance—debit balances on the debit side and credit balances on the credit side.

Here are some exercises for you to try!