Understanding Types of Business Organisations

When starting a business, choosing the right organisational structure is crucial. Each type comes with unique responsibilities, benefits, and challenges. Here’s a quick guide:

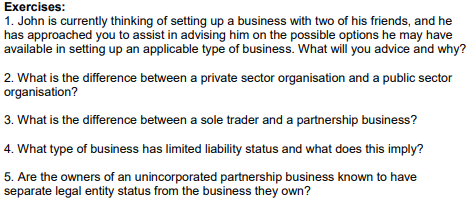

Public Sector Organisations

- Run by the government to deliver essential services like healthcare, education, and policing.

- Funded through taxes and national insurance.

- Not profit‑driven, focused on public welfare.

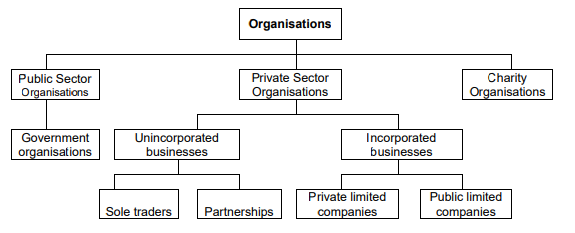

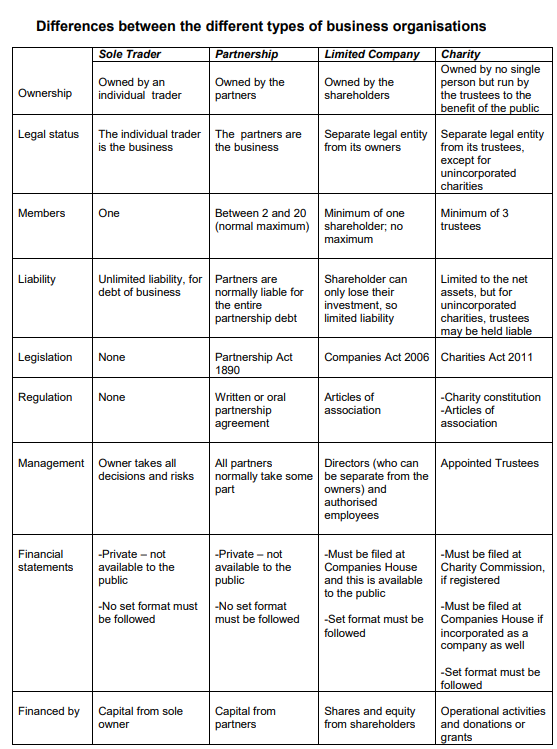

Voluntary & Not‑for‑Profit Organisations

- Includes charities and community groups.

- Aim to serve society rather than generate profit.

- Registered charities must comply with the Charities Act, file annual returns, and are exempt from corporation tax.

- Managed by trustees who ensure compliance and accountability.

Private Sector Organisations

These are profit‑oriented and can be structured in different ways:

Sole Traders

- Owned and run by one individual.

- Simple to set up, low costs, and full control.

- Unlimited liability: personal assets may cover business debts.

- Limited growth potential and challenges in raising capital.

Partnerships

- Owned by two or more people.

- Governed by the Partnership Act 1890 or a partnership agreement.

- Profits shared according to agreed ratios.

- Advantages: pooled expertise, shared workload, easier access to funds.

- Disadvantages: unlimited liability, potential disputes, and reliance on partners’ circumstances.

Limited Companies

- Separate legal entities distinct from their owners (shareholders).

- Liability is limited to the company’s resources.

- Private Limited Companies (Ltd): Shares not publicly traded, flexible ownership.

- Public Limited Companies (Plc): Shares traded on stock exchanges, stricter requirements, minimum £50,000 share capital.

- Limited Liability Partnerships (LLP): Hybrid structure offering limited liability with partnership flexibility, popular among professionals.

Pros & Cons of Limited Companies

- Pros: Limited liability, easier to raise finance, continuity, transferable shares.

- Cons: Complex regulations, mandatory public accounts, audits, and compliance with the Companies Act 2006.

Rights of Shareholders

Under the Companies Act 2006, shareholders can:

- Vote at general meetings.

- Receive share certificates.

- Inspect registers and directors’ service contracts.

Test Your Knowledge With These Exercises!