Many businesses use a petty cash system to manage small business payments. These payments are too small for writing a cheque. For example:

- Tea, coffee, and milk for the staff kitchen

- Window cleaning fees

- Other minor expenses

A staff member usually manages the petty cash float. This person is responsible for:

- Giving money to staff for small expenses

- Reimbursing staff who pay for business-related purchases from their own money

Funding and Receipts

Businesses top up petty cash from the cash book or bank. Sometimes, petty cash also receives small-value sales receipts, like stamps sold to staff.

It is important to follow these rules:

- Never use petty cash for personal expenses

- Always comply with the organisation’s policies

Petty Cash Vouchers

Most businesses use petty cash vouchers to record spending. Each voucher should include:

- Amount claimed

- Purpose of the purchase

- Date of the transaction

- Manager approval

Additional steps:

- Attach receipts to vouchers

- Number vouchers and store them in the petty cash box

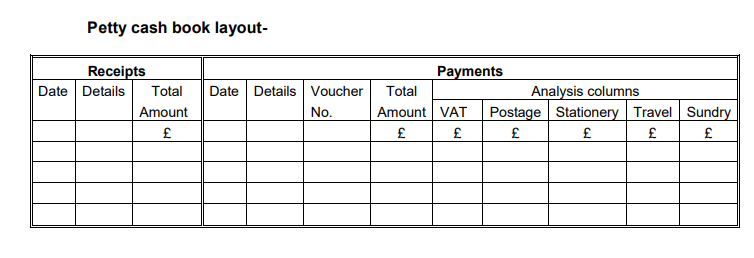

- Use vouchers to complete the petty cash book

- File vouchers for future reference

Policies and Limits

Businesses may have different petty cash rules, but common policies include:

- Vouchers must have receipts or proof of expense

- Set a maximum amount allowed for petty cash payments

- Certain small claims may not require proof

Always follow the petty cash policy when recording transactions.

Accounting and Bookkeeping

In accounting, the petty cash book can act as:

- A book of prime entry

- A ledger account

This approach helps businesses keep accurate petty cash records within the double-entry bookkeeping system.