The Cash book is a book of prime entry which is initially used to record all money transactions and then transferred into the general ledger. All monies received or paid out will have an entry in the cash book and this will include monies paid in and out in cash or through the bank.

In the accounting system and in the context of your assessment, you need to know that the cash book may combine the roles of the book of prime entry and the double entry bookkeeping, where it is maintained as a bank ledger account with debit and credit sides to the cash book. It can be maintained as a separate accounting record from the bank ledger account or kept together.

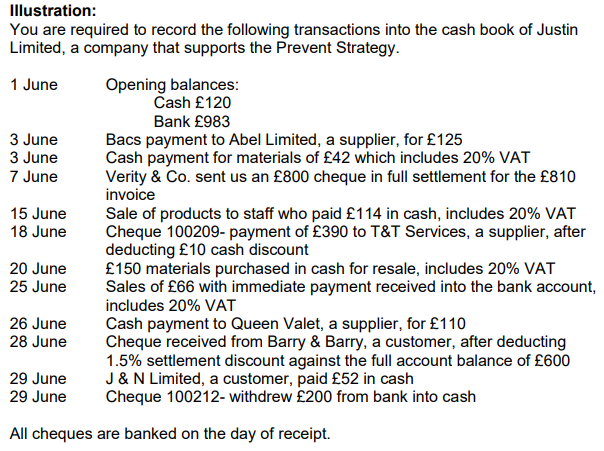

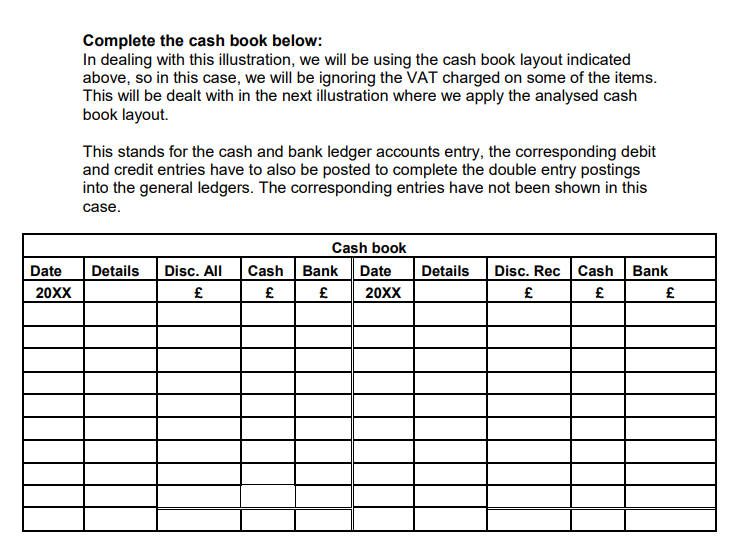

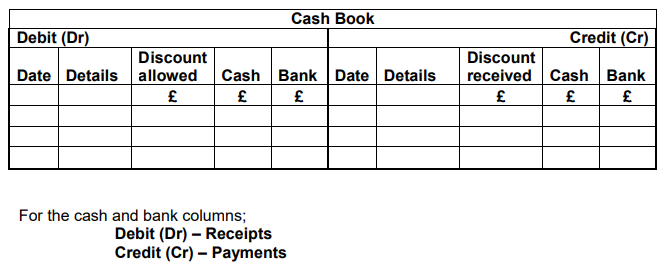

Cash book layout-

The cash book layout can be set up in different formats to suit the business. In this

case, the cash and bank accounts have been accounted for together in the same

cash book, where the debit column for cash is put next to the debit column for bank

and the credit column for cash is put next to the credit column for bank. The bank

columns deal with movement of monies in the real bank for which bank statements

are periodically received from the bank and reconciliations can then be carried out.

The cash column deals with movement of cash within the business.

The VAT and Discounts columns in the cash book do not form part of the double

entry postings, they are used as memorandum columns to list the VAT and

discounts not yet posted into the ledger, eg VAT arising from cash sales or cash

discounts taken up for early settlements. These need to be totalled and transferred

into the double entry system, that is, the debit and credit entries will need to be

posted.

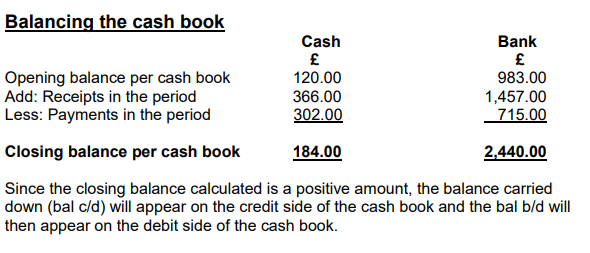

Balancing the cash book

On a regular basis- weekly or monthly, ledger accounts will need to be balanced

and closed off, showing the closing balance for the period. This periodic balancing

needs to be carried out in the cash book where the cash book is used as a ledger

account alongside being a book of prime entry.

The cash columns and the bank columns need to be balanced separately as these

represent two different ledger accounts. The VAT, Discounts and Analyses

columns in the cash book do not form part of the double entry postings, so these

columns do not need to be balanced off. The VAT and Discounts columns

should be added and then posted to the relevant ledgers in compliance with double

entry.

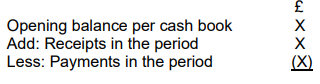

The following brief calculation will enable you find the cash book balance for the

cash and bank columns. This is particularly useful where separate receipts and

payments books may be maintained as seen in the analysed cash book.

If the closing balance calculated is a positive amount, the balance carried down

(bal c/d) will appear on the credit side of the cash book as a surplus in amount left

over from the trading period, but if it is a negative amount indicating an overspend

which is possible in the bank as bank overdraft, the balance carried down will be

on the debit side of the cash book.