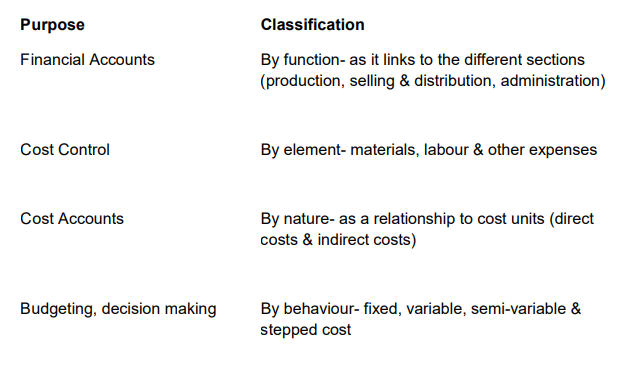

Every organisation in operation will usually incur costs of different kinds. Costs can be logically grouped in different ways. The particular grouping selected will depend on the purpose for which the resulting analysed data is intended to be used. Different forms of accounts will require accounting records and costs to be classified in different ways in order to be able to achieve the required results.

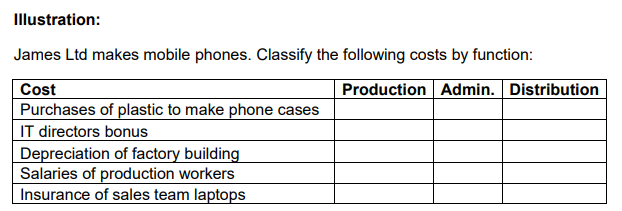

Classification of costs by function

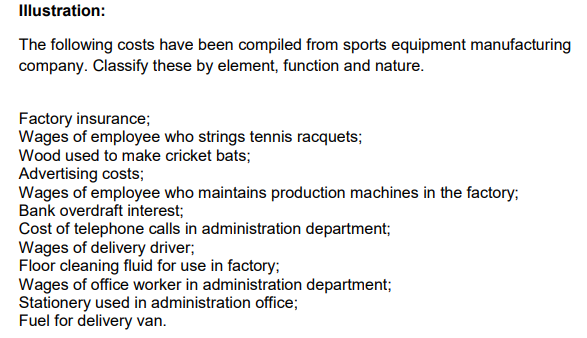

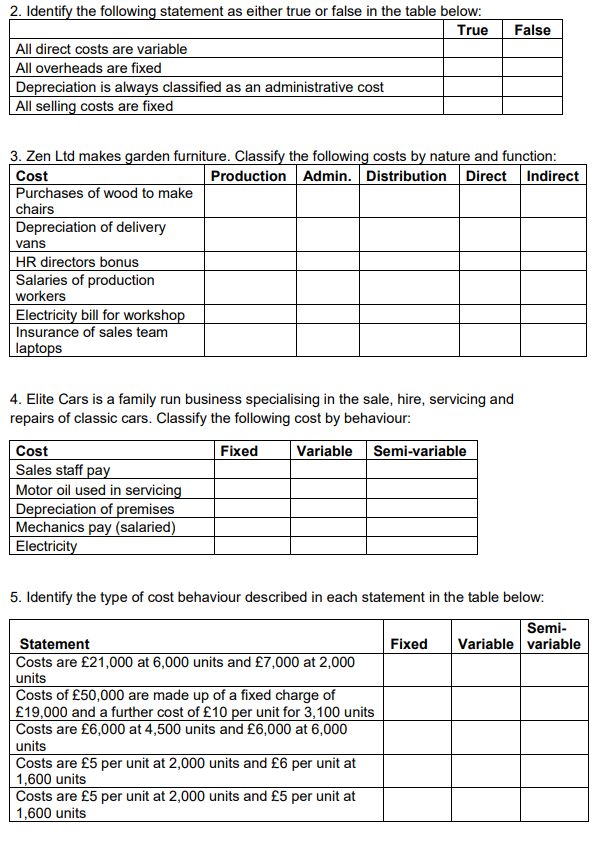

This is a classification that represents costs in respect of why the cost was incurred.

For financial accounting purposes, costs are split into the following categories:

Production costs- this is also known as “cost of sales”. This category would include production labour costs, materials, factory supervisor salaries, factory rent. These are any costs which are directly linked with organisations production process.

Selling & distribution costs- this will include any selling and distribution costs incurred by the organisation in getting the products to its end users. This category would include sales team commission, delivery costs.

Administration costs- this will include any other costs that are incurred in the organisations operations. This category would include all other head office costs, IT support, HR support.

Note:

One cost you may meet in the exam is depreciation. This is an allocation of the cost of fixed assets which represents the wear and tear or usage of the asset. The classification will depend on which asset is being depreciated. Depreciation can be classified by function, in the following manner

Production costs- depreciation on a factory machine used in the production line.

Selling & distribution costs- depreciation of a delivery van.

Administration costs- depreciation of an asset used in the HR department.

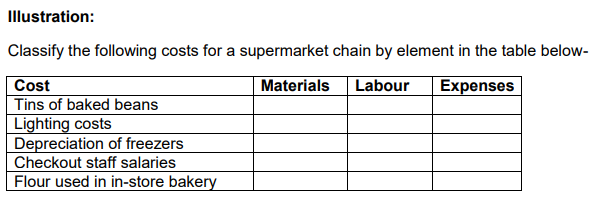

Classification of costs by element

Costs can be split into three elements-

Materials- these will include raw materials for a manufacturer, costs of goods to be resold in a retail organisation or service items or consumables to be used within a business operation.

Labour- these will include all salary and wages costs to employees, including overtime, commissions and bonuses.

Other expenses- this will include any other costs that are incurred in the organisations operations, such as, electricity, depreciation, rent, telephone. Most of these types of expenses are usually known as “overheads”.

Note:

For this unit and in your assessment, expenses are interpreted as overheads and these will be used interchangeably. For this unit, expenses will be known as overheads and will always be indirect in nature.

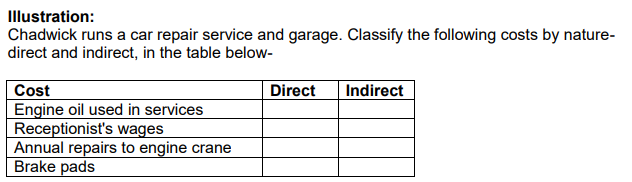

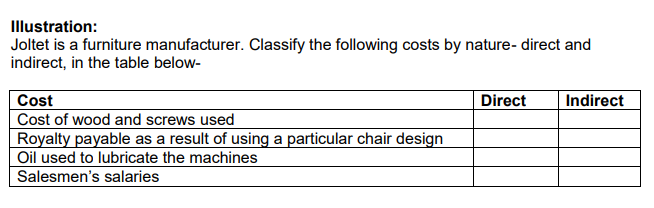

Classification of costs by nature-

To make calculating cost per unit easier, costs are split into the following categories-

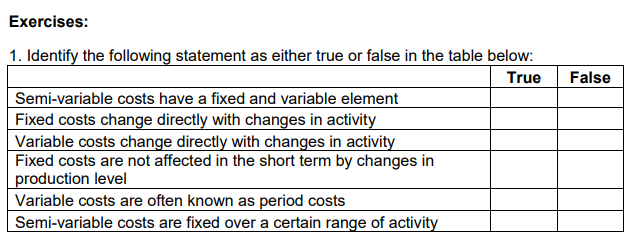

Direct costs- This is an item of cost that is traceable directly to a unit of production produced by a manufacturing organisation or a unit of service delivered by a service delivery organisation. The total of all direct costs is known as the “prime cost” per unit. These will include cost of raw materials used for production.

Indirect costs- This is an item of cost that cannot or cannot be easily identified directly with any one finished unit. Expenses that do not relate directly to production (non-production costs) will all be classified as indirect costs and these are usually known as “overheads”. These will include HR costs, IT support, selling & distribution.

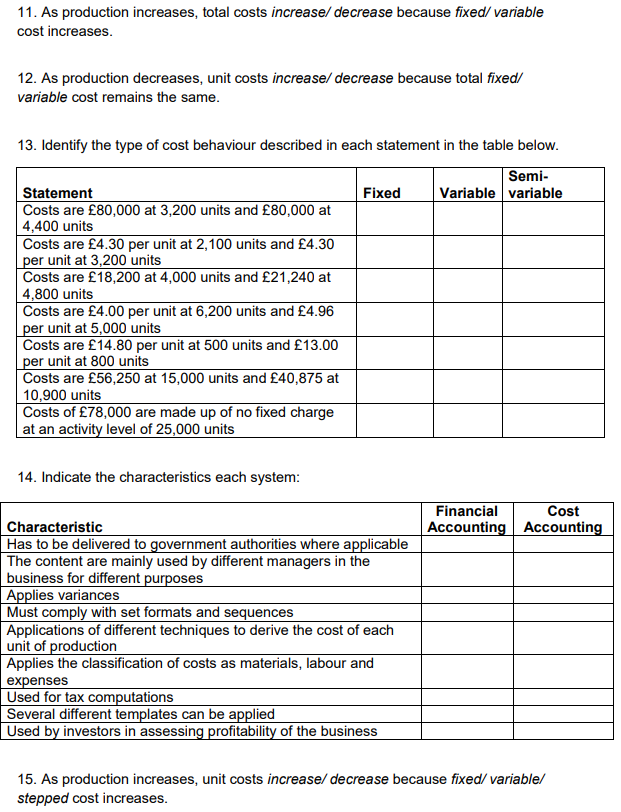

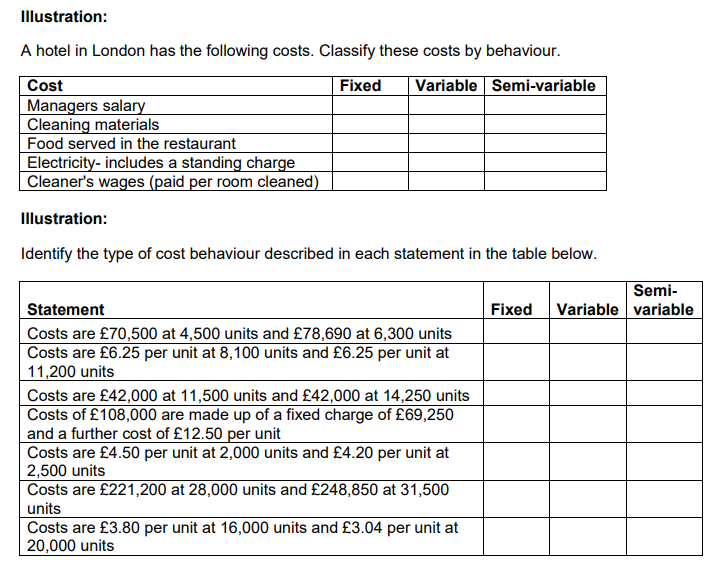

Classification of costs by behaviour-

For budgeting purposes, management need to be able to predict how costs will vary with differing levels of activity. For example, if a furniture manufacturer expected to produce 1,000 chairs in a month, what should he budget for the costs of wood, labour, oil, selling price, factory heating, etc? How would these costs differ, if at all, if he expected to produce 2,000 chairs?

To make budgeting and forecasting easier, costs are split into the following categories-

Variable costs- these are costs that vary with the level of production or activity. It is usually assumed to vary in direct proportion to production. For example, if you make twice the number of chairs then the assumption is that the amount of wood used would be doubled.

Fixed costs- these are costs that are not affected by changes in the level of production or activity, hence costs that don’t vary. For example, rent costs for a factory. It is assumed that if production increases, the factory rent cost would not be increasing based on the production volume. These costs are usually for set periods of time, so it isn’t affected by production levels, hence, it could be referred to as period costs. Period costs are time-based costs ie costs which are incurred in relation to a duration, such as rent or insurance for the month or year.

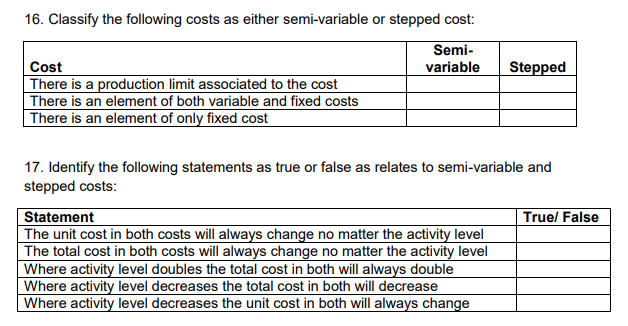

Semi-variable costs- these are costs that have a fixed element and a variable element. This means that if production were to double, the cost of production will not double because of the fixed cost element in the production cost, which will remain the same. For example, the cost of electricity for the factory has a fixed element relating to lighting and a variable element relating to power used in the production line.

Stepped costs- these are costs that remain fixed up to a particular level of activity, but which rise to a higher (fixed) level, if activity goes beyond that range. For example, a firm may pay £40,000 per year to rent a factory in which they can produce up to 1 million units of product per year. However, if demand increases to more than 1 million units, a second factory may be required, in which case the cost if factory rent may step up to, say, £80,000 per year and then be constant until we want to make 3 million units.

Difference between product costs and period costs-

Product costs are all costs incurred in making a product which will include cost of direct materials, direct labour and manufacturing overheads directly tied to the production process but period costs are costs incurred over a set period of time which are not part of the product costs. Period costs are not directly linked to each unit of the product and could include rent, insurance etc. and product costs are directly linked to producing the product.

Combining cost classifications-

In some tasks in your assessment you may be have to use more than one classification at a time. For example, Factory rent is a production cost that is fixed and indirect. Direct materials are a production cost that is also variable. Direct labour is not necessarily a variable cost. For a car repair service, for example, it is possible to identify how much time a particular repair takes (by using job cards to record time) but the mechanic may be on a fixed salary per month. Sales commission is a variable selling and distribution cost.