Many businesses sell their goods and services on credit and this gives rise to the risk

of one or more customers not paying after they have received the goods or services.

This may not be a regular occurrence in businesses, but where the goods or services

of a business are offered to its clients on credit, the risk of bad debt can’t be eliminated

completely, even if the customers have to sign contracts and credit checks are carried

out before offering the customer any credit facilities.

Bad debt is an amount owed to a business which may not likely be paid by the debtor,

having exhausted all possible means of chasing for the payment. Hence, such

amounts need to be written off the books of accounts and should not continue to be

presented within the debtors amounts as a current asset.

A bad debt is a loss to the business as it is a cost the business has to bear and so

should be written off as expenditure. This may occur where:

– A debtor declares bankruptcy

– The cost of chasing for the debt to be paid is more than the debt itself

– The customer disputes the debt and refuses to pay part or the full amount

– The business has other reasonable causes to believe the debt will no longer be paid

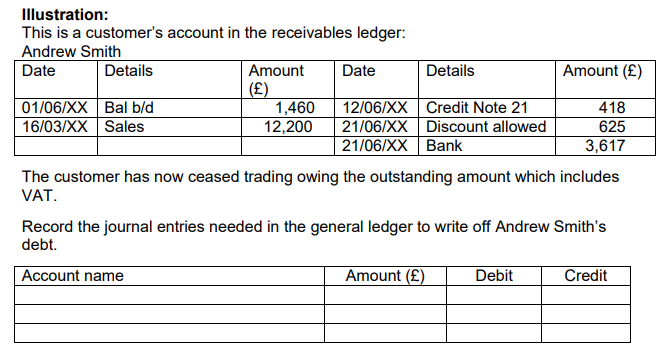

Bad debts are credited to the sales ledger and the sales ledger control account as a

reduction to the amount owed and debited to bad debt account which is an

expenditure account.]