Capital expenditure occurs when a business spends money in purchasing non-current assets for the business operations or when it spends money in adding value or improving an existing non-current asset. This will include delivery and legal costs in acquiring the non-current assets.

Non-current assets are items owned by the business which have some longevity and

will be used for a long period of time within the business. These are commonly known as fixed assets. Examples of these include buildings, machinery, furniture, motor vehicles etc.

When a business buys a new machine, this is classified as a capital expenditure and

is accounted for in the statement of financial position over a few years, because of

the longevity of the use of the machinery in the business.

Revenue expenditure are all other expenditure outside capital expenditure incurred

by a business in carrying out its daily operations. Such expenditure will include costs

incurred in the acquisition of current assets acquired for conversion into cash; costs

incurred in purchasing and selling of goods; day-to-day administration or operating

costs; and costs incurred in maintaining the revenue-earning capacity of the non-current assets.

All such expenditure is charged to the statement of profit or loss, because such

expenditure are usually used up within a short period of time and don’t add value to

any existing non-current assets.

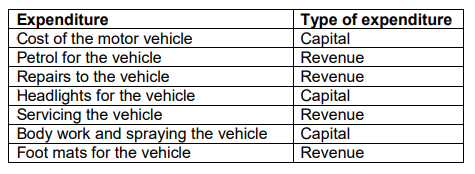

The differences between capital and revenue expenditure will be illustrated using a motor vehicle in a business.